What is REMA?

The UK government launched the Review of Electricity Market Arrangements, or REMA, in 2022 to find a route to decarbonise the market by 2035 whilst ensuring affordability and reliability. The review is an iterative process; each round REMA looks at aspects of the market and makes suggestions of how each could change in a report which is then published for feedback from market participants and wider stakeholders (known as a consultation). The policy options are assessed against deliverability, investor confidence, whole-system flexibility and value for money. The feedback is used to policy updates and decision-making on which options to discard or continue reviewing in another round. The first consultation ran from 18 July to 10 October 2022, and the second consultation is open now and closes 7 May 2024.

If you want to read the second consultation and give your opinion you can do so here: https://www.gov.uk/government/consultations/review-of-electricity-market-arrangements-rema-second-consultation

What exactly is REMA focusing on?

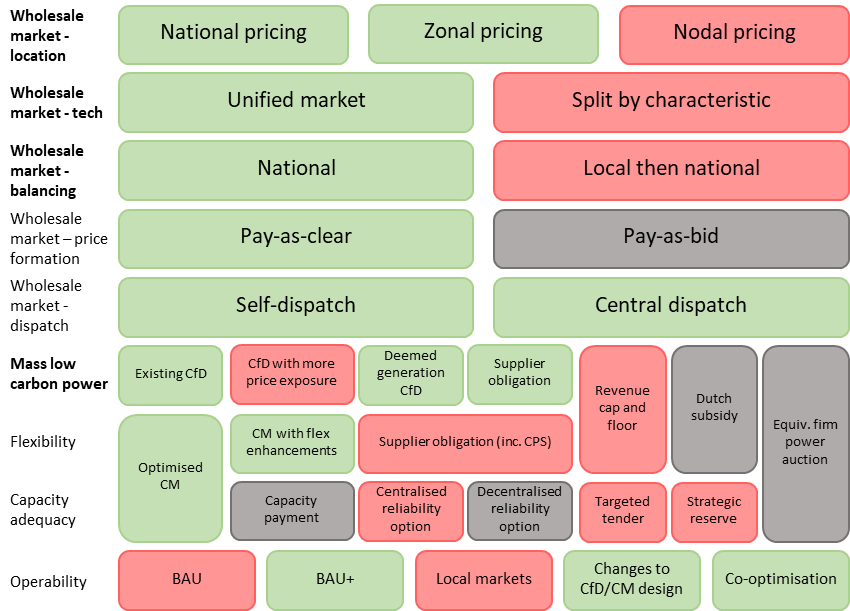

The shows the options REMA are considering. Items that were rejected at the first consultation have been greyed out. Green indicates the items REMA suggest move forward as part of this second consultation, and red those they suggest be rejected. Categories in bold have significant impact on small, behind the meter, generators (like rooftop solar) which we will discuss in more detail later on. For now, let’s take a look at each category individually…

Wholesale market – location

The UK uses national pricing for electricity, with uniform pricing across the country. Alternatives include zonal pricing, where different regions have unique prices, and nodal pricing, based on specific consumption points. Increasing location granularity could better address local generation and transmission costs but would increase operational complexity and costs. Furthermore, locational granularity would likely have little, or negative, impact on network constraint, as these issues primarily stem from lack of investment which may further decrease as radical change deters investors.

Wholesale market - tech

The market is currently unified. Separating the market by characteristic, e.g. renewable vs non-renewable, could enhance renewable promotion and supply transparency, but increases operational cost and complexity.

Wholesale market - balancing

The market must supply enough electricity to meet demand. Currently total national demand is met by nationwide supply. Balancing the supply and demand at a local level could enhance network efficiency but increases complexity.

Wholesale market - price formation

Generators bid to sell electricity to the grid. Currently, those successful are paid the highest successful bid price in a mechanism known as “pay-as-clear”. "Pay-as-bid" would mean payment matches individual bids, however this was rejected at the first consultation due to tactical bidding concerns.

Wholesale market - dispatch

Currently, generators self-dispatch, deciding themselves when to produce energy and supply to the grid. A centrally controlled dispatch system could optimise overall efficiency and security but would reduce generator autonomy.

Mass low carbon power

The government currently uses Contracts for Difference (CfDs) to promote large-scale low-carbon electricity, guaranteeing renewable plants a fixed price per kWh (strike price) regardless of market fluctuations. This system has proven effective, but REMA is considering adjustments like:

- A strike price range to increase exposure to wholesale price.

- Basing payments on predicted (“deemed”) rather than actual generation, to incentivise optimal use of asset.

- A cap and floor mechanism, where assets bid for a guaranteed minimum revenue but are limited to a maximum revenue.

The firm power auction (differentiating CfD auctions into variable and firm power categories) and Dutch subsidy (rewarding the amount of carbon avoided rather than the low carbon electricity produced) were rejected due to the radical market reform required. While the wider role of suppliers is still being explored, the supplier obligation (requiring suppliers to purchase green electricity) has been rejected as a main mechanism for renewable investment.

Capacity Adequacy & Flexibility

The Capacity Market (CM), which ensures long-term electricity supply and quick adaption to fluctuations in supply and demand, is currently dominated by gas; 66.97% of the 2023 four-year ahead capacity auction was awarded to gas power plants whereas renewables make up less than 5%[1]. Following the first consultation, remaining options for enhancing renewable participation include:

- Putting greater value on flexible low carbon technologies with quick response times (“CM with flex enhancements”).

- Offering multiple clearing prices to the bidding suppliers rather than one price. Known as optimised CM, this ensures capacity is met with as little procurement as possible.

- Focusing on renewable sources via a targeted tender bidding process.

- Keep the electricity in the CM separate to the electricity market. This reserve can therefore be used to meet demand if the regular electricity market participants cannot.

Capacity payment was rejected as it was unlikely to have benefit over existing payment arrangements. Similarly, a decentralised system was rejected as it would likely be more inefficient and costly than centralised. REMA recommends an optimised CM, procuring low-carbon flexible electricity via multiple clearing prices and procurement targets, and supported by flexibility technologies to respond to the variation in renewable output.

Operability

The further we move from the current market structure, the more difficult it is to operate. Options range from maintaining Business As Usual (BAU) or making minor enhancements (BAU+) to complete market reform such as local markets which requires the aforementioned pricing, dispatch and capacity market changes. Change to the electricity market necessitates change to the infrastructure; co-optimisation takes ancillary service reform into account and dedicated support scheme covers specific cost and delivery programs for both this and direct market changes.

Why does this matter?

How does all this impact small, behind the meter, generation plants like rooftop solar? Or consumers at the end of the line? As REMA is concerned with reform of the wholesale market, it is primarily the large generators participating in this area that will feel the change. However, as highlighted in the diagram above, there are a couple of points that we need to be aware of.

Locational pricing is great if you are a generator in an area where demand is high, but less so if demand is low. This could discourage potential installations and cause current assets to become less valuable or even stranded. Just as existing solar farms can’t pick up and move to a better location, the same is true for consumers - locational pricing could bring about costs that we have no ability to respond to.

Splitting the market would allow the consumer to benefit from the prospective low price of renewable electricity but would likely not benefit small generators. Existing assets, who receive the currently available CfD, would not see any difference if the market were to split. Furthermore, and especially true if the CfDs mechanism was made redundant,

split markets may lower returns for new sites by removing instances of high electricity prices.

Local balancing would likely benefit small generators, as it would require grid constraints to be addressed as a priority. Additionally, the generators and consumers anticipating the EV curve would be supported by local balancing.

The final point to highlight is that change brings uncertainty, and uncertainty deters investors. We see that, typically, moving right across the diagram above brings the more radical suggestions for reform. Whilst these might support decarbonisation, they also bring cost, risk, and complexity. Even now, due to the array of options REMA are considering and the ambiguity as to which will be the future, we can see investment moving overseas to more certain opportunities. REMA must consider all factors to ensure we have an affordable, secure, and successful net zero electricity market, but do so quickly in case they have no resources available when ready to change. But they need your opinions, as stakeholders and market participants, to effectively decide a path. So go have your say!

References/further reading

The first consultation (Government) –

Summary of the first consultation (Government) –

The second consultation (Government) –

Summary of the first consultation (Cornwall Insight) –

https://www.whatisrema.com/why-is-it-happening/initial-options-assessment/

Summary of the second consultation (Cornwall Insight) –

https://www.whatisrema.com/second-rema-consultation/

Some more interesting points:

https://modoenergy.com/research/rema-second-consultation-five-key-takeaways-battery-energy-storage

https://www.emrsettlement.co.uk/about-emr/capacity-market/

https://gbcmn.nationalgrideso.com/faq/general/what-is-the-capacity-market

https://researchbriefings.files.parliament.uk/documents/CBP-9871/CBP-9871.pdf

https://www.drax.com/power-generation/what-are-ancillary-services/

[1] https://www.emrdeliverybody.com/Capacity%20Markets%20Document%20Library/T-4%20DY%202027-28%20Final%20Results%20Report%20v1.pdf