So what is CSRD?

CSRD is reshaping sustainability reporting in Europe, impacting landlords, occupiers, and investors alike. With less than one third of firms stating in a recent survey (Semarchy, 2025*) that they are confident in their ability to fulfil the stringent reporting requirements, CSRD’s incoming requirements are undoubtedly feeling daunting to many.

How prepared is your company for CSRD compliance?

No matter how you feel about the question above - we’re here to help you with some of the key high-level points within the commercial real estate sector. This blog contains a quick breakdown of what matters most.

Finally, we’ll go over how Syzygy’s renewable energy offerings can help you make CSRD reporting an asset, not a risk.

CSRD basics

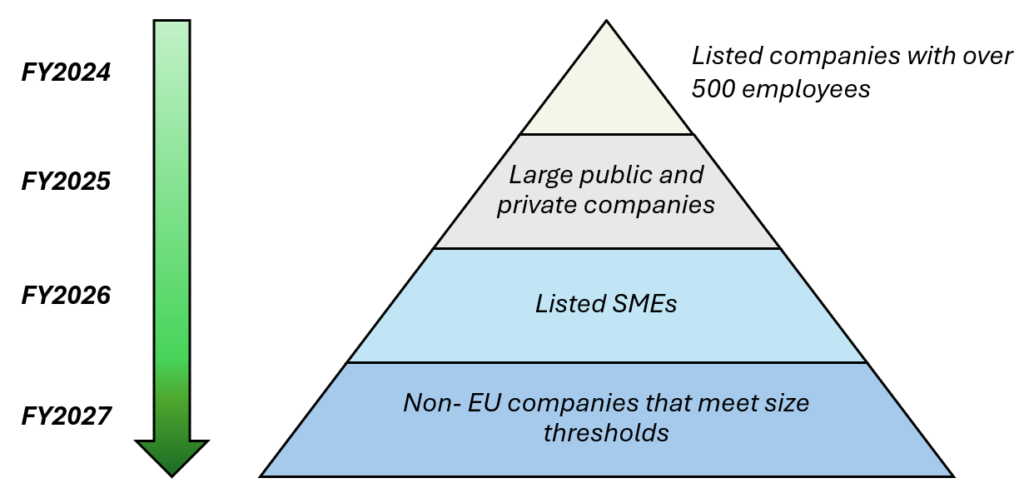

The Corporate Sustainability Reporting Directive (CSRD) is an incoming enhanced sustainability reporting directive due to start taking mandatory effect from this year. The implementation will occur in phases, starting first with the largest listed EU-based companies and ending with listed EU SMEs and non-EU companies that meet size thresholds.

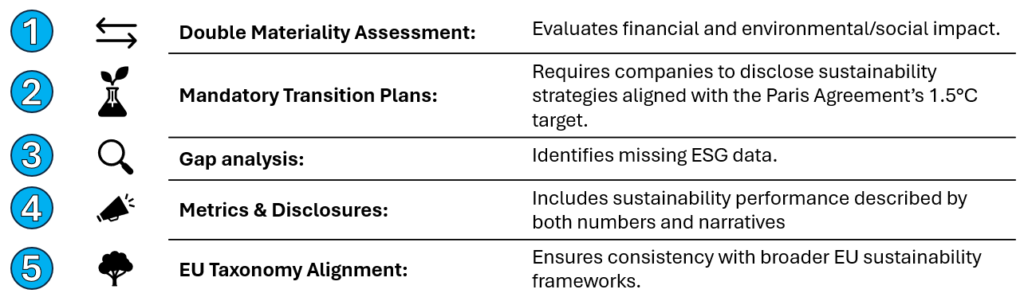

CSRD also brings in several new reporting elements within its European Sustainability Reporting Standards (ESRS), such as double materiality assessments and mandatory transition plan disclosures – These may be new for several occupiers and landlords, but are common to other incoming sustainability reporting frameworks (such as ISSB, TCFD, and to some extent SDR) in jurisdictions such as the UK as part of a wider effort to harmonise sustainability reporting.

CSRD reporting includes:

The reporting standard includes several aspects of sustainability, including social and non-climate based sustainability, but for this blog’s purpose the focus will be around ESRS E1 – Climate Change.

Effect on real estate

Buildings account for nearly 40% of EU energy consumption and 36% of CO2 emissions (EBPD 2024), meaning the effect of new sustainability regulations cannot be understated.

CSRD directly impacts landlords and occupiers, requiring greater transparency in sustainability reporting. The directive brings a new level of ESG accountability, shaping investment decisions, tenant preferences, and asset values.

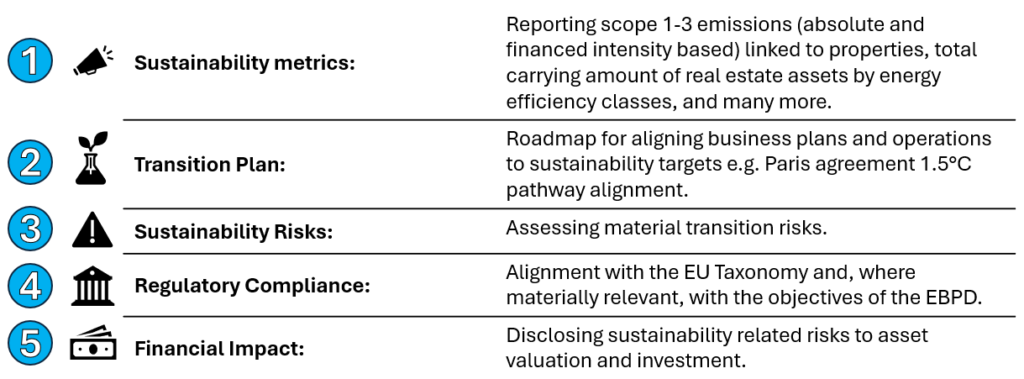

For landlords, this means enhanced sustainability reporting requirements including disclosures of Scope 1-3 emissions, transition risks, and alignment of their activities with regulations like the EU taxonomy.

Key landlord-based sustainability disclosures include:

Occupiers will need detailed ESG data from landlords to meet their reporting obligations, and will likely place sustainability alignment higher in their priorities when choosing which real-estate assets to interact with.

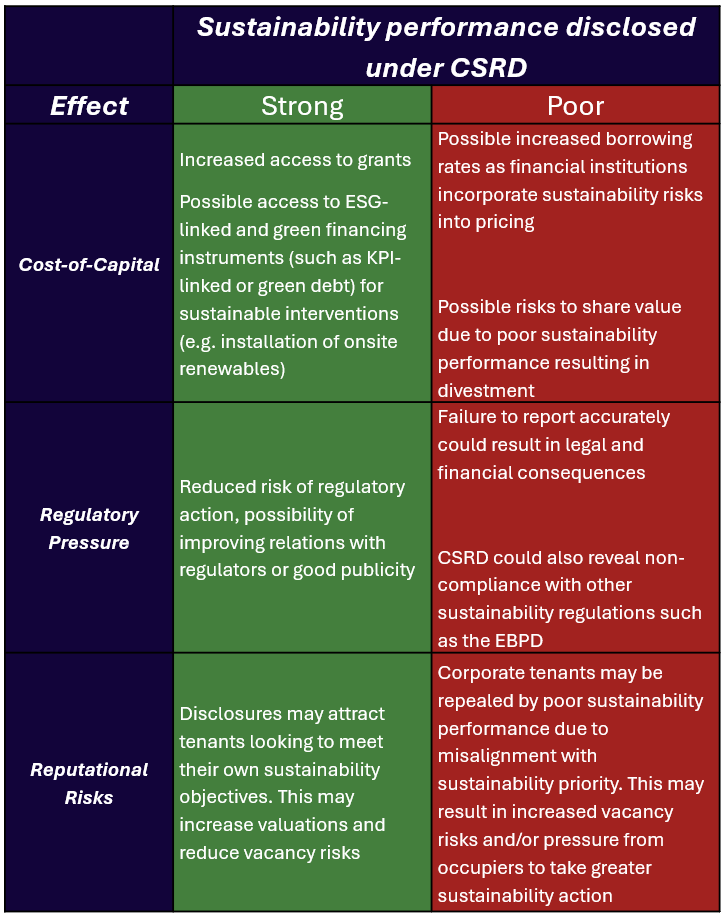

The rewards for good sustainability performance to be disclosed under CSRD are plenty, but this can easily go the other way if the sustainability disclosures seen indicate poor performance.

Example effects of sustainability good and bad sustainability performance under mandatory CSRD disclosures:

How can Syzygy help?

CSRD reporting requires asset owners to prove sustainability strategies—not just talk about them. That’s where Syzygy comes in.

Syzygy’s solar PV, EV charging, and battery storage energy solutions can help meet CSRD requirements, as well as generate financial and ROI opportunities, in the following ways:

- Decarbonisation: Energy solutions provided by Syzygy’s consulting and project management teams can help reduce occupier and landlord emissions, improving carbon and renewable energy metrics.

- Transition plan strategies: Syzygy’s interventions can help provide tangible proof of decarbonisation strategies being acted upon, strengthening CSRD disclosures.

- ESG Data Management: The Asset Management team can help monitor sustainability and energy metrics, assisting with data gaps for CSRD reporting.

So, the benefits of the solutions above are numerous – enacting them keeps your CSRD journey in the green. Potential access to cheaper green/ sustainability-linked funding, future proofing of assets along with cost savings, and possible growth in value of properties may yet be ahead of you due to putting in the decarbonisation work now.

With over 1500 projects (primarily in solar PV and EV) delivered, expertise in sustainability strategies within real estate portfolios, and dedicated asset management services to help track ongoing performance – Syzygy are here to help you meet your CSRD obligations and turn the incoming regulation to your advantage!

References:

*The Semarchy CSRD Data Readiness Report - Semarchy / 83% of firms not ready for EU's CSRD compliance