Context to the electricity market and historical pricing

Price volatility has become all too familiar in the energy market over the past few years. Energy price volatility is driven by supply and demand fluctuations and has been exacerbated by global events such as the COVID-19 pandemic and the war in Ukraine. Suppliers trading on futures markets to manage this volatility have faced increased challenges, leading to some withdrawing from offering prices when rates spike.

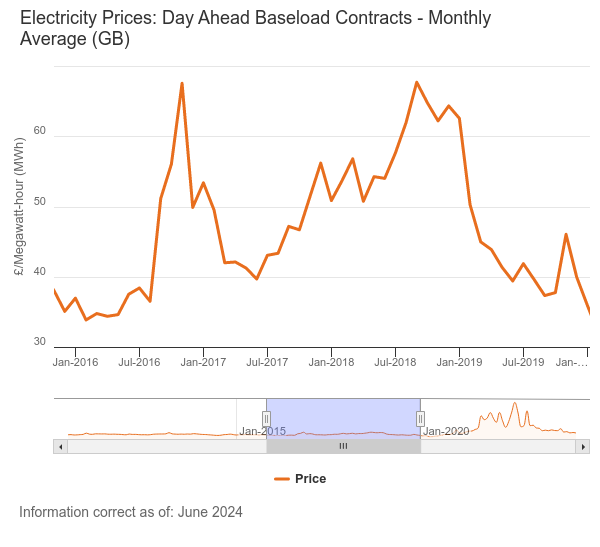

Despite the falling wholesale electricity market, prices are still at a historical high. We are in the midst of an energy crisis and it’s a global issue caused by a set of unforeseen circumstances, heightened by issues unique to us here in the UK.

Across Europe, a long and cold winter between 2020 and 2021 increased reliance on natural gas, depleting reserves across the continent causing supply shortages. These shortages were especially pronounced in the UK as our capacity to store natural gas is drastically low compared to our European counterparts; it equates to approximately 2% of our annual demand compared to 25% of annual demand for the average European country. Early in 2022, the supply of gas via Nord Stream 1 was cut to 20% massively reducing the amount of natural gas available in Europe before being closed altogether later that year.

Infrastructure issues have also contributed to the energy crisis. In response to the Russian invasion of Ukraine, Germany postponed the Nord Stream 2 opening set to transport c.55 billion cubic meters of gas per year between Russia and Europe. With such a vast supply no longer available and demand increasing in a post-pandemic world, demand far outweighed supply and continued to push the prices higher.

So how did we transition from a period of such volatility to the falling energy prices of today?

What’s happening now?

Two years of far milder winters, a move to greater reliance on liquified natural gas and an uptake in energy-saving initiatives in response to the possibility of unaffordable energy bills have caused the wholesale electricity market to calm. The IEA reported a general downward trend in wholesale electricity prices across the world in 2023 with day ahead contract pricing on the UK wholesale market currently around £120/MWh according to Ofgem and ICIS figures.

Prices continue to fall as the market adapts to the change in supply and as demand naturally reduces over the spring and summer months, but they are still far above the levels of a pre-pandemic UK, see Figure 1 below.

Cornwall insights have revealed that electricity prices are unlikely to move below pre-pandemic levels until the late 2030s. A demand for power caused by the move to electrifying heating and cooling and transportation is cited as the main reason for this.

What does this mean moving forward?

As further low-carbon and cost-effective energy sources are added to the UK’s network, the forecast trend for the wholesale electricity market is downwards. However, as we transition to an affordable Net Zero society there will be a growing increase in the electrification of the economy which has the potential to slow the price downturn.

Moving forward, it is imperative the UK is prepared for the move to a Net Zero world. Based on recent global geo-political events and future pricing forecasts, the need to develop long-term storage solutions is of up most importance to managing the supply and demand of the market, and therefore mitigating pricing risk for consumers. Richard Palmer, Director of Strategic Projects at Syzygy said: “To achieve Net Zero, we need market reform which not only maintains investor confidence but incentivises investment in long-duration storage technologies, new forms of low carbon dispatchable generation, including thermal generation with Carbon Capture and Storage and hydrogen powered generation – and Nuclear is likely to play a key role as part of the future energy mix. The characteristics of a net zero power system will be supporting periods of system security at times when the wind isn’t blowing, and the sun isn’t shining.”